Crypto leverage trading has revolutionized the way traders interact with cryptocurrency markets, enabling them to amplify their potential gains by borrowing funds to trade larger positions than their initial investment allows. This powerful tool can unlock new opportunities but also carries increased risks.

In this guide, we’ll break down the essentials of crypto leverage trading, exploring how it works, its benefits, and the potential pitfalls to watch out for. Whether you’re a seasoned trader or a beginner, understanding leverage trading is key to navigating the dynamic and often volatile crypto markets effectively and responsibly.

What Is Crypto Leverage Trading?

Leverage trading in cryptocurrencies enables you to increase your exposure to the market without committing a substantial amount of capital upfront. Essentially, you are borrowing funds to magnify your trading position beyond what would be possible with your account balance alone.

How It Works: When you engage in crypto leverage trading, you’re initiating a position by using a fraction of the total value as a margin. For example, with a 10:1 leverage, you might be able to control a position of $10,000 with only $1,000 of your own capital.

Risks and Rewards:

- Increased Potential Profit: Leverage can amplify gains. If the market moves in your favor, you can potentially realize larger profits on the capital you personally invested.

- Higher Risks: Just as it can magnify profits, leverage can also multiply losses. A market move against your position may result in larger losses and could happen quickly.

Key Considerations:

- Margin Calls: If the market moves against your position by a certain amount, you’ll be subject to a margin call, which requires additional funds to maintain your position.

- Liquidation: Falling below maintenance margin could lead to the automatic closure of your position to prevent further losses.

- Market Volatility: Crypto markets are known for their volatility. This can be both an opportunity and a risk when trading with leverage.

By using leverage, you’re accepting a higher risk for the possibility of higher rewards. It is important to understand your tolerance for risk and to consider using risk management strategies when trading with leverage.

How Crypto Leverage Trading Works?

In crypto leverage trading, you use borrowed funds to increase your trading position beyond what would be available from your capital alone. This is known as trading “on margin,” where your initial investment is the “margin,” serving as collateral for the borrowed funds.

Margin and Collateral:

- Margin: The amount of capital you provide from your funds.

- Collateral: Your stake securing the loan, which can be part of or all the margin.

When you enter a leverage trade, the margin is a fraction of the position’s total value. For example, with a 10x leverage, your $250 could open a $2,500 position.

Leverage Ratio:

- Ratio: The multiple of your funds used for the position (e.g., 2:1, 10:1).

- Affects both potential profit and loss; a higher ratio magnifies both.

Liquidation and Maintenance Margin:

- Maintenance Margin: The minimum balance you must maintain to keep a position open.

- If your balance falls below this level, a “liquidation” can occur—where your position is forcibly closed to prevent further losses.

The risk of liquidation is higher with greater leverage, as price fluctuations can more rapidly deplete your margin. Becoming well-versed in these concepts is crucial to managing risk and capitalizing on the opportunities leverage trading offers in the cryptocurrency market.

What Is Leverage in Crypto Trading?

In the realm of cryptocurrency trading, leverage is a tool that multiplies your position in a trade without requiring you to commit the full amount of capital. Essentially, leverage allows you to borrow funds from a broker or exchange to increase your buying or selling power. This mechanism amplifies both potential profits and potential losses.

How Leverage Works:

- Initial Capital: Your own funds used as collateral.

- Multiplier Effect: Leverage is expressed as a ratio (e.g., 10:1, meaning that for every dollar of your own, you control $10 worth of cryptocurrency).

Key Points:

- Borrowed Capital: You use funds provided by a third party to enhance your trade.

- Position Size: You can open a larger position than your available capital would normally permit.

- Amplified Results: Profit and loss potential are both increased; thus, risk management is crucial.

When you enter into a leveraged trade, you’re essentially agreeing to a position size that your actual capital doesn’t cover. If your trading position goes in your favor, you can yield a profit much larger than what your initial deposit would have allowed. However, if the market moves against you, losses will also be magnified, and there’s a risk that you can lose more than your initial investment.

For Example:

- Without Leverage: With $500, you might buy $500 worth of cryptocurrency.

- With 10x Leverage: Your $500 could control a $5,000 position.

Remember to adhere to the rules and regulations of your country when it comes to trading with leverage, as there can be legal restrictions regarding who can participate and which assets can be traded this way.

Types of Crypto Leverage Trading

Crypto leverage trading enables you to open larger positions with a smaller initial capital. This is achieved by borrowing funds, which can amplify both potential profits and potential losses. There are three main types of leverage trading in the cryptocurrency market: spot trading with leverage, margin trading, and derivatives trading.

Spot Trading with Leverage

With spot trading, you’re buying or selling the actual cryptocurrency for immediate delivery. When using leverage in spot trading, you’re essentially borrowing money to increase your purchasing power. It’s less risky than other forms of leverage trading but still can lead to substantial losses if not managed carefully.

- Pros: Direct ownership of assets; immediate settlement

- Cons: Limited leverage compared to derivatives; rapid market changes can still bring significant risk

- Examples: Coinbase allows for spot trading with some leverage options.

Margin Trading

Margin trading is borrowing funds from a broker (or an exchange) to trade cryptocurrencies. You use your existing coins as collateral to open a position that is larger than your current asset value.

- Pros: Higher potential profits; more trading opportunities with less capital

- Cons: Possibility of margin calls; higher risk and potential for significant losses

- Examples: Binance and Kraken provide margin trading facilities with varying levels of leverage.

Derivatives Trading

Derivatives trading includes instruments like futures and options, allowing you to speculate on the future price of cryptocurrencies without owning the underlying asset. These contracts can offer high leverage.

- Pros: Potentially high leverage; no need to hold the actual cryptocurrency

- Cons: Complexity of instruments; amplified losses are possible due to high leverage

- Examples: BitMEX and Bybit offer cryptocurrency futures contracts with high leverage levels.

When choosing the best type of trading for your goals, consider your risk appetite. If you’re risk-averse, spot trading with minimal leverage may be preferable. If you’re willing to take on more risk for the potential of higher returns, margin or derivatives trading may align better with your goals, but always be cautious of the heightened risk.

How to Trade Crypto with Leverage

When you decide to trade cryptocurrencies with leverage, you’re effectively borrowing funds to increase your trading position beyond what would be available with your cash balance alone. It’s important to approach this with caution, as leverage magnifies both potential profits and potential losses.

To begin trading with leverage, these are the typical steps:

- Open a Trading Account: Select a reputable leverage trading platform and create an account.

- Deposit Funds: Transfer the necessary funds into your trading account, usually a percentage of your intended trading position.

- Choose Trading Instruments: Decide on the cryptocurrency you wish to trade and at what leverage ratio (e.g., 10:1).

- Place a Trade: Execute your trade and monitor the market closely.

Managing risk is crucial:

- Use Stop-Loss Orders: This can help you automatically close the trade at a predetermined price and manage potential losses.

- Monitor Margin Requirements: Ensure you maintain the minimum margin required to keep the positions open.

Adopt best practices:

- Start Small: Begin with lower leverage to test strategies without high risk.

- Stay Informed: Keep up to date with market trends and news.

- Risk Management: Only trade what you can afford to lose.

Remember, while leverage can amplify returns, it can also exacerbate losses, making it vital to trade judiciously and use risk mitigation techniques.

Risks and Challenges of Crypto Leverage Trading

Leverage trading in the crypto market enables you to handle a larger position with a smaller capital outlay. However, this comes with significant risks due to the inherent volatility of cryptocurrencies. Prices can swing wildly within short periods, making leveraged positions prone to sharp movements that could lead to substantial losses. So, to avoid huge losses, make sure to calculate your crypto leverage.

Slippage is another challenge that can affect the execution of your trades, especially in highly volatile markets. Slippage occurs when there is a difference between the expected price of a trade and the price at which the trade is actually executed.

With leveraged trading, the fees can be higher. These could include interest on borrowed funds, transaction fees, and any other charges applied by the exchange or broker. Furthermore, the regulatory environment for leveraged crypto trading varies across jurisdictions, which can affect access to leverage and the types of assets you can trade.

To mitigate these risks, one strategy is to use stop-loss orders which automatically close your position at a predetermined price to limit potential losses. Diversifying your portfolio is also a wise approach to spread out risk.

Common mistakes to avoid include:

- Over-leveraging: Borrowing more than what you can afford to pay back can lead to magnified losses.

- Ignoring trade costs: Always account for all the fees involved in executing leverage trades.

- Lack of research: Fully understanding the asset you’re trading and the market conditions is critical.

Remember that while leverage can increase potential gains, it also multiplies the magnitude of losses, so approach it with caution and awareness of the associated risks.

What Is Bitcoin Leverage Trading

Bitcoin leverage trading is a strategy enabling you to gain greater exposure to the Bitcoin market than what your actual capital allows. By borrowing funds from a broker or exchange, you can enter larger trades and potentially enhance your profits. However, this comes with increased risk since losses can also be amplified.

Key Points About Leverage Trading:

- Borrowed Capital: You can take a position larger than your actual funds.

- Amplified Trades: Increase potential profit or loss from market movements.

- Margin: The initial deposit you need to open a leverage position.

When you engage in leverage trading, if the market moves favorably, your returns are magnified relative to your initial margin. Conversely, market movements against your position can result in losses exceeding your deposit, leading to a ‘margin call’ where you must add additional funds or close the position at a loss.

Examples:

- 10x Leverage: With $1,000, you can open a position worth $10,000.

- Margin Call: If losses reach a certain threshold, you must act to preserve the position.

It’s imperative to approach leverage trading with caution. Understand the terms of the agreement with the platform providing the leverage, and be aware of the level of risk you’re comfortable with. Remember that while leverage can multiply gains, it can just as quickly multiply losses, especially in the volatile Bitcoin market.

Frequently Asked Questions

In this section, you’ll find concise answers to common questions about crypto leverage trading, providing you with clear insights into starting out, understanding leverage effects on trading, margin requirements, and the meaning of different leverage levels.

How can beginners start with crypto leverage trading?

To start with crypto leverage trading, you must first open an account with a crypto exchange or broker that offers leverage trading. Ensure you understand the risks and have adequate knowledge about trading strategies and risk management.

How does leverage affect potential profits and losses in crypto trading?

Leverage amplifies both potential profits and losses. A higher leverage means a smaller move in market price can lead to a proportionally larger gain or loss compared to the capital you initially invested.

How do margin calls function in the context of cryptocurrency leverage trading?

A margin call occurs when your account balance falls below the required margin level. You are then required to deposit additional funds or sell a portion of your assets to cover the shortfall and maintain your leveraged position.

What Is 2x Leverage in Crypto?

At 2x leverage, you’re borrowing funds to double your trading position. For example, with a $500 investment, you can open a $1,000 position in the market.

What Is 5x Leverage in Crypto?

5x leverage allows you to trade with a position size five times greater than your initial capital. With $200, you could enter a trade worth $1,000.

What Is 10x Leverage in Crypto?

With 10x leverage, your crypto trade is magnified by ten times the value of your actual capital. This means a $100 investment enables you to control a $1,000 position.

What Is 20x Leverage in Crypto?

20x leverage means you can trade positions 20 times greater than your available capital. A $50 investment would allow you to take a $1,000 position using 20x leverage.

What Is 50x Leverage in Crypto?

Using 50x leverage, investors can hold positions fifty times larger than their original investment. As such, a $20 investment can be leveraged to control a $1,000 position in the market.

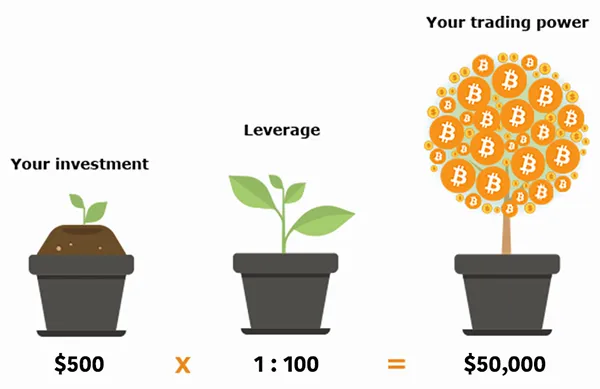

What Is 100x Leverage in Crypto?

100x leverage boosts your buying power to a hundredfold over your initial investment. With just $10, you could potentially manage a position size of $1,000.

Conclusion

Leverage in crypto trading amplifies your potential gains, but it also increases your exposure to risk. By managing positions three to twenty times the size of your initial investment, you have the potential to achieve substantial profits. This financial tool can be highly efficient, turning a $1,000 investment into a $5,000 position using a 5:1 leverage ratio.

However, it’s imperative you understand the associated risks. With leverage, a small price movement can lead to significant losses or even the liquidation of your position. As such, it is essential that you approach leverage trading with a well-thought-out strategy, including risk management techniques like stop-loss orders to protect your capital.

Before you begin, ensure that you are aware of the rules and regulations applicable in your country. Not everyone is eligible to trade with leverage, and not all types of assets can be traded in this manner. Adhering to these regulations is crucial for a compliance-conscious trading approach.

Trading with leverage is not something you should enter into lightly. As you consider leverage trading, remember the importance of education and continuous learning. It’s not just about magnifying profits, but managing the proportionally magnified risks as well. Trade responsibly and with caution, making sure that each decision is informed by both knowledge and a respect for the volatile nature of the cryptocurrency markets.