As cryptocurrency markets evolve, traders are continually seeking strategies to maximize returns, especially with leverage trading. Leverage allows traders to control larger positions with less capital, amplifying potential gains—but also risks. In 2025, the importance of effective strategies is greater than ever, as market volatility and innovation create both opportunities and challenges.

This guide explores the best crypto leverage trading strategies for 2025, tailored to help traders navigate this dynamic landscape. From risk management techniques to advanced trading setups, these strategies are designed to empower both beginners and experienced traders to optimize their leverage use while minimizing potential losses.

Best Crypto Leverage Trading Strategies in 2025

Always Use Isolated Margin

When you enter the realm of crypto leverage trading, understanding the distinction between isolated margin and cross margin is pivotal for managing risk. Isolated margin earmarks a specific portion of your capital to a single position. This means the margin is independent of your account balance, safeguarding the rest of your funds should a margin call occur. On the contrary, cross margin distributes your entire account balance across all open positions, which can increase your risk exposure.

Here’s an example to illustrate the benefits of isolated margin:

- You take a leveraged position on cryptocurrency A, opting for an isolated margin.

- You allocate $1,000 with a 5x leverage ratio, borrowing $4,000.

- If cryptocurrency A’s price drops, only the $1,000 and borrowed funds tied to that specific trade face the risk of liquidation, protecting your remaining balance from being affected.

To choose the right margin level, consider these tips:

- Assess your risk tolerance: Smaller margins are prudent if you prefer lower risk.

- Factor in volatility: High volatility in a cryptocurrency increases the chance of a margin call.

- Understand the leverage ratio: A higher leverage multiplies both potential gains and losses.

- Review broker requirements: Each broker or crypto leverage exchange may have varying policies for margin trading.

In essence, isolated margin affords you explicit control over each investment, turns a spotlight on individual trade risk management, and can potentially prevent a domino effect of liquidations within your account.

Trade Only a Couple of Coins

When engaging in crypto leverage trading, concentrating on a select few cryptocurrencies can be advantageous for maintaining focus and potentially improving your performance. Diversifying over too many assets may lead to scattered attention and an inability to monitor the market effectively for each coin.

Criteria for Selection:

- Liquidity: Opt for coins with high liquidity to ensure smooth entry and exit from positions.

- Volatility: Choose coins that exhibit significant price movements, which can allow for profitable trading opportunities when leveraging.

- Market Sentiment: Stay informed about the general attitude toward the coin. Strong sentiment can influence price movements.

Examples of Coins:

- Bitcoin (BTC): Known for its high liquidity and significant market presence.

- Ethereum (ETH): Offers substantial liquidity as well, with frequent price changes.

- Polygon (MATIC): Though smaller in market cap, it has pronounced volatility and growing popularity.

Here’s how you can manage the risk:

- Use stop-loss orders to curb potential losses. A good practice is setting a stop loss at a point that represents a tolerable level of loss aligned with your risk-reward ratio.

- Consider using take-profit orders to automatically lock in profits at a predetermined price level.

- Avoid the temptation of overly magnifying your positions with excessive leverage; more modest ratios can help to manage potential losses.

Remember, the key to leverage trading is not just the profit potential, but also managing the risk through deliberate and informed trading decisions.

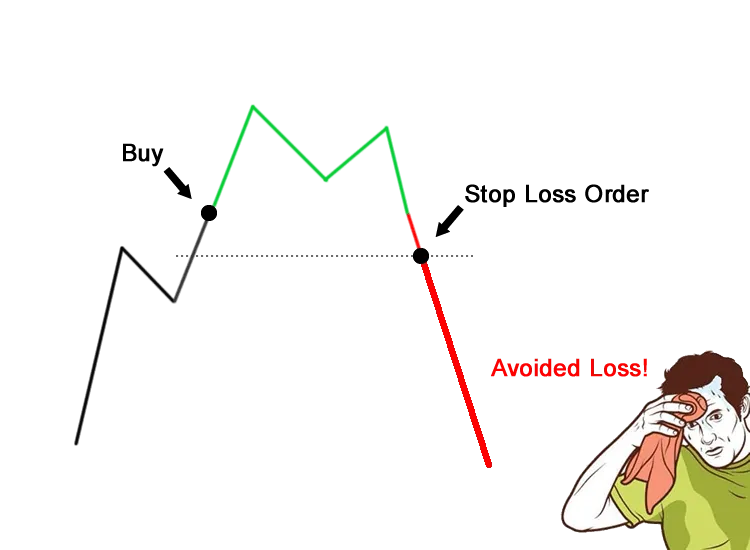

Using Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are automated instructions that you, as a trader, set to close a position when a certain price is reached. These orders serve to enforce your risk management strategy, ensuring you are prepared for various market scenarios.

Stop-Loss Orders

A stop-loss order is your defense mechanism against escalating losses. If the market moves against your position, the stop-loss order is executed, closing the position to prevent further loss. It’s critical to set the stop-loss at a level that reflects your risk tolerance and the volatility of the cryptocurrency you’re trading.

- To establish an optimal stop-loss level, consider:

- Price percentages: A rule-of-thumb is to set stop-losses at a percentage of your entry price.

- Support levels: Place stop-loss orders just below key support levels.

- Volatility: For volatile cryptos, wider stop-loss margins may be necessary.

Take-Profit Orders

Conversely, a take-profit order secures your profits by closing a position once it reaches a predetermined price that signifies a satisfactory gain. This helps in capitalizing on favorable movements without the risk of a reversal eroding your earnings.

- For setting take-profit levels, evaluate:

- Risk-reward ratio: Common ratios are 2:1 or 3:1, where for every dollar risked, two or three dollars are targeted for profit.

- Resistance levels: Take-profit orders can be placed just before historical resistance levels.

- Trading strategy: Align your take-profit points with your overall trading goals.

Example: If you enter a trade at $100, with a stop-loss at $90 (limiting loss to 10%) and a take-profit at $120 (aiming for a 20% gain), your trade is structured to maximize potential gains while managing the risk of loss.

In dynamic markets, these orders help you maintain discipline, taking emotion out of the equation. They ensure you adhere to your initial trading plan, regardless of market fluctuations.

Use Trailing Stop-Loss Orders

A trailing stop-loss order is an adaptive risk management tool that you can use to protect gains as well as mitigate losses. This type of order automatically adjusts the stop price at a fixed percentage or dollar amount below or above the market price, depending on whether you’re long or short.

Tips for Adjusting Trailing Stop-Loss Orders:

- Percent vs. Fixed Value: Choose between a percentage or a fixed amount for your trailing stop based on the volatility of the cryptocurrency. Highly volatile assets may require a larger percentage to avoid stop-outs.

- Assess Market Conditions: In a trending market, a wider trailing stop can allow you to capitalize on larger price movements. Conversely, in a ranging market, consider a tighter stop to protect against frequent price reversals.

- Regular Review: Adjust your trailing distance as your position moves in your favor to lock in profits while still giving the trade room to grow.

Examples in Different Market Conditions:

- Trending Market: Imagine Bitcoin is in a strong uptrend. You enter a long position and set a trailing stop-loss order 5% below the highest price reached since you opened your trade. As Bitcoin climbs, your stop-loss price ascends accordingly, helping you secure profits if a sudden reversal occurs.

- Ranging Market: Ethereum is oscillating within a known range. You take a short position near the top of the range with a trailing stop distance set at 2%. The market descends but then moves upward temporarily. Your trailing stop minimizes the risk by potentially exiting the trade before the price hits the range’s ceiling.

Implementing Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy you can use to build your position in cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or Polygon (MATIC) by investing a predetermined amount of capital at regular intervals, regardless of asset price. This method reduces the impact of volatility on the overall purchase of your crypto assets.

To effectively implement DCA:

- Determine the total investment you’re willing to commit.

- Decide on how frequently you’ll invest (e.g., weekly, bi-weekly, monthly).

- Divide your total capital by the number of periods to calculate the installment amount.

In bullish markets, where prices are on an upswing, DCA prevents you from investing all your funds at a peak, thereby lowering your average entry price over time. Conversely, in bearish markets, when prices are falling, DCA allows you to accumulate more crypto units for the same investment amount, positioning you well for potential recoveries.

Example:

| Market Type | Investment Action |

| Bearish | Accumulate more units |

| Bullish | Lower average cost |

It’s advisable to use a conservative risk ratio initially and adjust as you become more confident in trading crypto. By consistently following the DCA method, you can mitigate risks associated with price fluctuations and benefit from the potential long-term growth of your crypto investment. Remember, patience and consistency are key when employing DCA in leverage trading strategies.

Mastery of Technical Analysis and Indicators

In leveraging your crypto trading, a strong grasp of technical analysis and the appropriate indicators can substantially enhance your ability to read market trends and potential turnaround points in both spot and futures trading. Technical analysis involves examining past market data to forecast future price movements. Indicators, on the other hand, distill this data into manageable forms, signaling potential entries, exits, and continuation patterns.

To tailor your approach, consider these aspects of selecting indicators:

- Trading Style: Match indicators to your trading speed. Day traders might favor the Relative Strength Index (RSI) for quick sentiment snapshots, whereas long-term investors could utilize Moving Averages to discern persistent trends.

- Timeframe: Fit indicators to your charting timeframe. The MACD might be valuable on a daily chart for capturing momentum over weeks, whereas Bollinger Bands could equip you with immediate volatility insights on an hourly basis.

During heightened volatility, utilizing indicators such as Bollinger Bands can illuminate the expansion of price ranges, guiding your leverage decisions more precisely. In tranquil markets, Fibonacci Retracement levels can offer keen support or resistance areas for entry or profit-taking.

Applying these tools in margin trading demands a commitment to risk management. Using stop losses and not over-leveraging your trading capital are prudent starting points to coincide with the signals that technical indicators provide. By merging accurate indicators with robust risk management tools, you’re gearing your investment strategy for better stability, even within the volatile realms of forex and crypto markets.

Application of Fundamental Analysis and News

Fundamental analysis involves assessing the intrinsic value of cryptocurrencies by examining related financial, economic, and other qualitative and quantitative factors. Blockchain technology and its adoption rates, the team behind a cryptocurrency, token economics, market demand, and competitors are significant elements that can impact the value of a cryptocurrency. Using fundamental analysis, you can evaluate whether a cryptocurrency is overvalued or undervalued.

To stay updated on factors that could affect your investment or trading decisions, follow credible news sources. Pay attention to:

- Price movements: They can be influenced by news such as regulatory changes or technological advancements.

- Leverage: Understand how news affects market sentiment, which can magnify price movements when trading with leverage.

- Margin: Be mindful of how economic indicators affect market liquidity and margin requirements.

How to Find Relevant Information

- Search for reliable financial news platforms and blockchain analytic tools.

- Look at historical data and compare it with current market conditions.

Applying Information to Market Events

During a market dip, fundamental analysis could suggest buying opportunities if fundamentals remain strong, while news of regulatory approval might signal a bullish trend. Conversely, negative news coupled with weak fundamentals might suggest a potential sell-off.

Use fundamental analysis alongside news to gauge market sentiment and make informed decisions, particularly when trading with leverage, where the stakes are higher due to borrowed capital.

Incorporation of Sentiment Analysis and Social Media

Sentiment analysis is a tool that evaluates the emotional tone behind a body of text. This technique is pivotal in cryptocurrency leverage trading, as it allows you to assess the collective mood and opinions of market participants by analyzing comments, tweets, and articles across social media and news platforms.

Why Sentiment Analysis is Important:

- Gauges Market Sentiment: It indicates whether the market is bullish or bearish on a cryptocurrency.

- Anticipates Volatility: Sudden shifts in sentiment can signal potential increases in market volatility.

- Informs Your Trading Strategy: You might decide to take a position based on prevailing market sentiment.

Utilizing Social Media:

- Social media platforms like Twitter and Reddit can provide real-time insights into the views and reactions of individual investors and influencers.

- Track trending hashtags related to cryptocurrencies to measure public interest and speculation.

Tools for Sentiment Analysis:

- Cryptocurrency Exchange Dashboards: Often include indicators of sentiment.

- Dedicated Social Media Analytics Tools: Track mentions and sentiment scores associated with cryptocurrencies.

Tips on Using Sentiment Analysis in Leverage Trading:

- Align your trades with the overall sentiment but be wary of sudden changes.

- Observe for discrepancies between market sentiment and actual price movements.

- Consider the impact of sentiment on highly leveraged positions, since increased leverage amplifies risk.

Examples of Sentiment Analysis Application:

- Bull Market: Positive sentiment might reaffirm your decision to maintain or increase a long position.

- Bear Market: Negative sentiment alerts you to possible downturns, suggesting it might be prudent to close a position or open a short.

In summary, leveraging sentiment analysis and monitoring social media are valuable practices for enhancing your crypto leverage trading strategy. They equip you with a sense of the market’s emotional undercurrent, which, when used judiciously, can lead to more informed trading decisions.

Use risk-reward ratio and position sizing

Understanding the risk-reward ratio and position sizing is critical in crypto leverage trading strategy. Your risk-reward ratio measures the potential profit of a trade against its potential loss. It’s the balance between the maximum risk you’re willing to take and the potential profit you aim to achieve.

For example, if your potential profit (reward) is $3 for every $1 you risk, your risk-reward ratio is 1:3. A favorable ratio is typically 1:2 or higher. This means for every dollar risked, at least two dollars are expected as a reward.

Position sizing involves determining how much capital to allocate to a trade based on your risk tolerance. It ensures that losses do not significantly impair your trading capital.

Here’s a simple formula for calculating position size:

Position Size = Account Risk / Trade Risk

Where:

- Account Risk is the amount of your total trading capital you’re willing to risk on a single trade, often expressed as a percentage (e.g. 2%).

- Trade Risk is the difference between the entry price and the stop-loss price, which defines the amount you’re willing to lose if the trade doesn’t go as planned.

Consider using a crypto position size calculator for accurate calculations.

In a volatile market, if you anticipate a breakout, you might spot opportunities with higher risk-reward ratios, like 1:20. This means the potential reward is twenty times greater than the risk, making the trade more appealing if the probability of success is reasonable.

By employing an optimal risk-reward ratio and proper position sizing, you protect your capital from excessive exposure while aiming for profitable trades. This strategy allows you to stay consistent, manage your risk effectively, and increase your chances of a successful trading career.

Employing Hedging and Diversification

In the realm of cryptocurrency leverage trading, managing risk is essential. Two pivotal strategies you can use to reduce risk are hedging and diversification. Hedging involves taking an opposite position in the market to your original investment to mitigate potential losses caused by volatility. For example, if you’re holding Bitcoin, you might use options or futures contracts to hedge against a price drop.

Diversification, on the other hand, spreads your investment across various assets, reducing the impact of a decline in any single investment. By not putting all your capital in one currency, you buffer your portfolio against market swings. A diversified portfolio might include a mix of cryptocurrencies, stablecoins, and other blockchain-based assets.

| Hedging Instruments | Description |

| Options | Contracts that give you the right, but not the obligation, to buy or sell an asset at a predetermined price. |

| Futures | Agreements to buy or sell an asset at a fixed price and specified date in the future. |

| Short Positions | Investment strategies that speculate on the decline in price of an asset. |

In a bear market, hedging can safeguard your investments from losing value, while in a bull market, diversification allows you to profit from various assets as they rise in value. Together, these risk management tools offer a robust approach to leverage trading in crypto. They balance your portfolio and reduce exposure, which lessens the possibility of liquidation risk. The key is to blend these strategies effectively to align with your individual risk tolerance and investment goals.

Executing Scalping and Day Trading

Scalping in crypto leverage trading involves entering and exiting BTC or other crypto trades within minutes to capitalize on small price changes. Your goal here is to accumulate multiple gains, which can add up to significant returns over time. It is essential to work with low fees because frequent trading increases transaction costs which can erode profit margins.

In day trading, you aim to benefit from the market’s volatility within a single day, never leaving positions open overnight to avoid additional risks such as price gaps. Effective day trading requires a comprehensive understanding of market momentum and trading capital management.

Strategies for Scalping and Day Trading

- Leverage: Utilize leverage cautiously. Higher ratios offer more exposure but come with increased liquidation risk.

- Risk Management: Implement strict stop-loss orders to protect your capital. A good rule is to risk no more than 1-2% of your capital on a single trade.

- Trading Platforms: Use platforms like Binance that offer professional traders advanced tools and low fees.

Techniques for Effective Execution

- Monitor Closely: Scalping requires you to stay on top of market trends constantly.

- Technical Analysis: Use support/resistance levels, moving averages, and chart patterns to make informed decisions.

- Fees and Margin: Ensure your returns justify the trading fees and margin costs.

Examples of Scalping and Day Trading in Different Market Environments

- Bull Market: Take advantage of momentum by entering long positions and targeting rapid price spikes.

- Bear Market: Look for opportunities to enter short positions when prices are dropping, capturing profits on the way down.

Remember, scalping and day trading require discipline and a well-crafted strategy. Your ability to execute trades efficiently largely determines your success.

Practicing Swing Trading and Trend Following

Swing trading is a strategy aimed at capturing gains from the price movements of cryptocurrencies over a period of days to several weeks. Your advantage lies in the ability to capitalize on the ‘swings’ or significant changes in market momentum. Trend following, on the other hand, involves the study of market trends to identify potential return opportunities through sustained movements either upwards or downwards.

To be successful with swing trading, you must be proficient in technical analysis and have a keen eye for market momentum. Position sizing is essential; allocate only a portion of your portfolio that aligns with your risk-reward ratio. This means deciding on how much you’re willing to risk for a potential profit target. Crafting this can help you consistently make profitable trades even when market directions change.

Among the strategies for swing trading and trend following:

- Spot the trend: Identify patterns such as higher highs in an uptrend or lower lows in a downturn.

- Fine-tune entries and exits: Use technical indicators like moving averages to pinpoint entry and exit points.

- Risk management: Calculate your risk with each trade, ideally risking a small percentage of your total capital.

For instance, if you’re trading BTC and notice a consistent upward trend, you could follow this trend and set a position to capitalize on the potential continued rise. Conversely, altcoins often exhibit strong trends that can be profitable for swing traders, whether bullish or bearish.

Remember, leveraged trading involves borrowed funds, amplifying both your profits and losses. Always consider leveraging cautiously and only if you understand the associated risks.

Canadian crypto trader? Check out these best leverage trading exchanges in Canada

Engaging in Breakout and Reversal Trading

Breakout trading is a dynamic strategy where you aim to enter the market as the price moves outside a defined range, typically breaching key levels of support or resistance. When trading with leverage, this can amplify your returns if timed correctly due to increased buying power. However, it also increases risk, so it’s imperative to utilize stop-loss orders to protect your margin.

Reversal trading, on the other hand, involves identifying when a current trend is losing momentum and is about to change direction. It requires a keen understanding of market sentiment and volatility, often using the risk-reward ratio to gauge whether a potential reversal trade is worth entering.

Effective Breakout Trading Techniques:

- Recognize the Setup: Look for periods of low volatility and narrow price ranges as precursors to potential breakouts.

- Volume Confirmation: Ensure there is sufficient trading volume behind the breakout to reduce the risk of false breakouts.

Reversal Trading Strategies:

- Use Indicators: Moving averages, RSI, or MACD can signal a weakening trend.

- Price Action Analysis: Candlestick patterns such as ‘head and shoulders’ or ‘double tops’ may indicate reversals.

In sideways markets, breakout trading can be crucial for identifying new trends. Conversely, in trending markets, reversals can signal lucrative exit or entry points. For traders, the ability to straddle these two strategies could lead to diversified trading opportunities.

Remember, both strategies necessitate a rigid adherence to risk management principles due to the enhanced risks leveraged trading brings. Always consider the risk-reward ratio, and don’t commit more capital than you can afford to lose.

Utilizing Arbitrage and Market Making

In leverage trading of cryptocurrencies, arbitrage stands as a pivotal strategy. It’s your process of capitalizing on price discrepancies of the same asset across different exchanges. As crypto exists on various platforms, you may find a coin priced lower on Exchange A compared to Exchange B. The concept is straightforward: buy at a lower price on one exchange and sell at a higher price on another, profiting from the difference.

Market making, on the other hand, involves providing liquidity through the continuous buying and selling of crypto assets. By placing limit orders on both sides of the order book, you contribute to a currency’s liquidity and capture the spread between the buy and sell prices.

When leveraging these strategies, considering fees is crucial. Different exchanges charge varying trading fees which can eat into your profits from arbitrage. Opt for exchanges with low fees to maximize returns. Here is an example breakdown of actions in an arbitrage trade:

- Identify a price discrepancy between exchanges.

- Calculate potential profit after accounting for trading fees.

- Execute simultaneous trades to buy low on one exchange and sell high on another.

For effective market making:

- Set buy and sell orders around the current market price.

- Monitor the market constantly to adjust your orders to maintain liquidity.

- Use trading bots for higher efficiency in fast-moving markets.

In both strategies, use margin wisely to amplify your capital efficiency, understanding the risks of potential losses. Moreover, choose brokers or exchanges that offer deep liquidity pools to ensure that your trades are executed without significant slippage, which can impact your arbitrage opportunities and market making activities.

Interested in annoymous trading? Check out these best decentralized exchanges

Leveraging Backtesting and Demo Trading

Backtesting is a method where you apply your trading strategy to historical market data to assess its viability. It’s essential to include both bearish and bullish market conditions to gauge the strategy’s robustness. Notable benefits of backtesting include identifying the performance in various market conditions and understanding the potential drawdowns, which refer to the peak-to-trough decline over a specific recorded period of investment.

When conducting backtesting, consider using platforms like TradingView or software like MetaTrader that provide tools for historical data analysis. It’s crucial to look at metrics such as the Sharpe ratio, an indicator of risk-adjusted return, and maximum drawdowns to understand the risk involved.

Demo trading, on the other hand, allows you to simulate leverage trading in real-time without risking actual capital. This practice can be particularly useful for margin trading, where the stakes are higher due to the use of borrowed funds to increase potential returns. Through leverage trading crypto platforms like OKX, you can engage in demo trading of futures and options with various leverage ratios, getting accustomed to the mechanics without jeopardizing your initial investment.

- Benefits of demo trading:

- Realistic market experience without financial risk

- Opportunity to test out leverage ratios

- Hands-on practice with futures and options

The combination of backtesting and demo trading is invaluable, especially within the context of leverage trading where the risk is amplified by increased exposure. Use these techniques to refine your trading strategies, ensuring that when you enter the market, you are equipped with a tested approach and a polished skillset. Remember, in leverage trading, the potential for significant profit comes with the risk of amplified losses, making these preparatory steps critical.