In the high-stakes world of crypto trading, leverage can amplify profits but also significantly increase risks. Leveraged positions face liquidation when account balances can’t cover the required margin, a safeguard by crypto leverage platforms to prevent excessive losses.

Liquidation is common in the volatile crypto market, especially in derivatives like margin trading and futures. Events like Bitcoin’s 15% drop on April 18, 2021, which led to $10 billion in liquidations. This article explores the causes, consequences, and strategies to manage liquidation, offering insights for traders aiming to use leverage responsibly and effectively.

Causes of Crypto Leverage Liquidation

Crypto leverage liquidation is a critical event that every margin trader should be aware of. This process occurs when your position is closed by the exchange because the value of your assets falls below the margin requirement. Here, we’ll explore the main triggers of such liquidations.

Price Movements

Extreme volatility in the price of cryptocurrencies like Bitcoin (BTC) can lead to rapid changes in your margin level. A sudden drop can cause significant losses, pushing your position closer to the liquidation price. This exposes you to the risk of having your holdings automatically sold off by the exchange to cover the leveraged position.

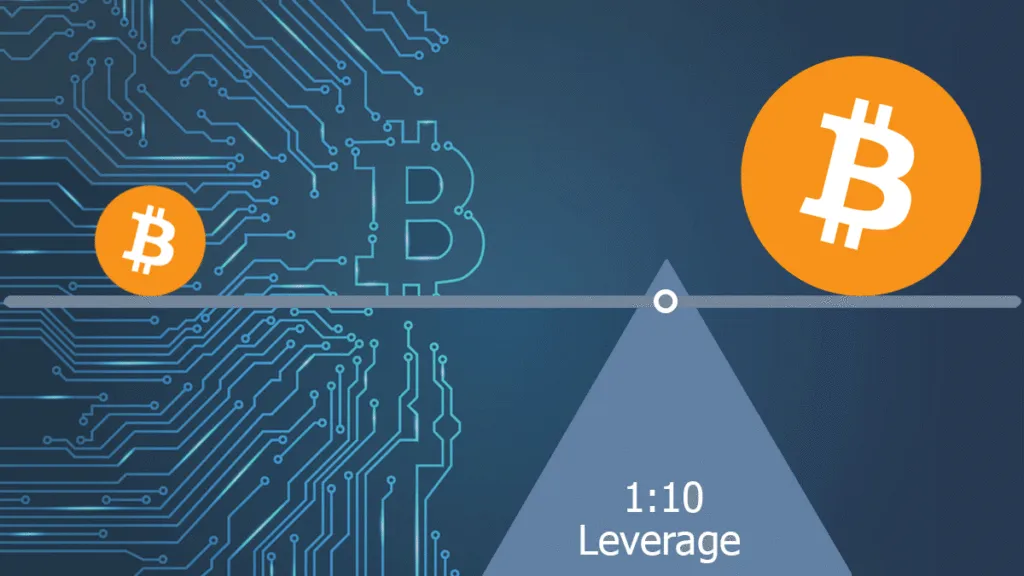

Leverage Ratio

The use of high leverage amplifies both gains and losses. Using a high leverage ratio means you are borrowing more money to increase the size of your position with less capital. While this can lead to substantial profits with small price movements in your favor, it also dramatically increases the risk of liquidation when the market moves against you.

Liquidation Price

The liquidation price is set by your margin trading platform. It represents the price level at which your position is automatically closed to prevent further losses. As BTC value fluctuates, so too does your liquidation price; falling asset prices might result in hitting this critical level and activating a forced liquidation.

Margin Call

A margin call occurs when the exchange informs you that your account’s margin level has fallen below the required threshold. Receiving a margin call is a warning that you need to either deposit more funds or reduce your open positions to avoid liquidation. Should you fail to meet the margin requirements, the exchange will proceed to liquidate your position to mitigate the risk of potential loss.

Consequences of Crypto Leverage Liquidation

Leverage in the crypto market can amplify gains, but it also significantly increases the risk of liquidation. When your position is liquidated, the consequences spread across your personal finances, the broader market, and your psychological state.

Financial Losses

When you’re liquidated, you may lose your initial margin and, in some cases, face a deficit if the asset’s value drops far enough. Forced liquidation occurs when the value of your collateral falls below a certain threshold, prompting a crypto exchange to close your position to minimize further losses. The high leverage common in crypto trading can lead to losing more than the funds you had initially committed.

- Example: A $100 million sell-off in the crypto market triggers liquidation of leveraged positions worth $700 million.

Market Effects

Large-scale liquidations ripple through the crypto market, often leading to increased volatility and abrupt price changes. Cascading liquidations can strain the market’s liquidity and exacerbate the price movements, which affects other traders and can lead to further liquidations. This cycle of downfall could potentially lead to market inefficiencies, making it difficult for the market to recover quickly.

- Statistic: An $800 million liquidation across crypto assets can signal a peak in high volatility.

Psychological Effects

Being liquidated can cause a torrent of psychological distress. The stress and anxiety of financial loss, combined with the frustration of a forced exit from the market, can impact your mental well-being. These effects can linger, influencing future trading decisions and potentially leading to a cycle of fear-based or overly cautious trading behaviors.

- Reminder: Your mental health is crucial to your longevity and performance in the trading sphere; manage your risk accordingly.

Prevention Strategies of Crypto Leverage Liquidation

Successful navigation of the crypto leverage landscape requires a blend of disciplined risk management, insightful market analysis, and ongoing education. Implementing leverage trading strategies in these areas can significantly reduce the likelihood of liquidation.

Risk Management

Your trading plan is the foundation upon which all successful trades are built. You should clearly define your investment goals and risk tolerance. It’s crucial to utilize tools like stop-loss orders to safeguard your positions from unpredictable market swings. Here are specific risk management strategies you should consider:

- Set Stop-loss Orders: Determine the price at which the system will automatically close your trade to prevent further losses.

- Limit Leverage Use: Opt for a lower leverage ratio to minimize the risk to your capital.

- Monitor Margin Requirements: Keep a vigilant eye on the margin requirements to ensure that you have enough funds to maintain open positions.

Market Analysis

Before you execute trades, it’s important to conduct detailed market analysis. Thoroughly research the assets you plan to trade and stay updated on market happenings that could affect those assets. Utilize these practices to stay ahead in market analysis:

- Research: Study the historical performance and volatility of the crypto asset.

- Stay Informed: Follow news related to the crypto market to anticipate price movements.

- Trading Indicators: Use technical indicators to guide your trading decisions.

USA Crypto Trader? Check out these Best Leverage Crypto Exchanges USA

Education and Training

To build a stronghold against liquidation, continuous learning and refinement of your trading skills are imperative. Your trading prowess is bolstered through a comprehensive understanding of both basic and advanced trading concepts. Embrace these educational steps to enhance your trading abilities:

- Utilize Resources: Consume reputable educational content on technical and fundamental analysis.

- Practice Trading: Engage in paper trading or use demo accounts to simulate real-world trading without financial risk.

- Trading Strategies: Familiarize yourself with various trading strategies and identify which suit your style and objectives best.

Frequently Asked Questions

In this section, you’ll find concise answers to common queries about crypto leverage liquidation, a critical concept for traders using leverage in the volatile cryptocurrency market.

How is liquidation price calculated in cryptocurrency trading with leverage?

Your liquidation price in cryptocurrency trading with leverage is determined by the exchange or trading platform based on your margin balance, the amount of leverage you are using, and the maintenance margin required. This price represents the value your trade must reach before the platform forcibly closes, or liquidates, your position to prevent further losses.

What tools are available to prevent liquidation during high volatility in the crypto market?

To avoid liquidation, you can use stop-loss orders, which automatically execute a trade at a predetermined price, and margin alerts, which notify you when your account value approaches the maintenance margin. Some traders also employ less leverage, as lower leverage increases the distance between the market price and the liquidation price.

Can a position with 1x leverage be subjected to liquidation under any circumstance?

At 1x leverage, your position is fully funded by your own capital without borrowed funds, which typically protects you from liquidation. However, if the value of your asset depreciates to zero, or if there are fees or other account-specific costs that cause your margin balance to fall below the required level, your position may still be at risk.

UK Crypto Trader? Check out these Best Crypto Leverage Trading Platforms in UK

Conclusion

In the dynamic crypto market, leverage magnifies both gains and losses, compelling traders to act with prudence. Liquidation occurs when your position is closed by the exchange because the value falls below the maintenance margin.

The precision of trading strategies and risk management protocols can make the difference between survival and capitulation.

Risk management is pivotal; you must assess the balance between potential returns and the risk of liquidation. Educating yourself on market indicators and having a deep understanding of the assets you trade will guide your decisions.

It’s essential to set stop-loss orders to mitigate losses and preserve capital. Additionally, diversifying your portfolio can spread risk across various assets.

The recent spikes in liquidations, with millions of dollars wiped out, underscore the peril of excessive leverage. Leverage amplifies the impact of price movements, and while this can lead to significant profits, it can also result in substantial losses.

Being aware of the leverage you’re using and understanding that the crypto market can move sharply and unpredictably will help you avoid the pitfalls of liquidation. You can also calculate crypto leverage to cut losses.

In summary, smart trading strategies and continuous education are your allies against the volatility of the cryptocurrency market. Upholding stringent risk management practices not only benefits you as a trader but also aids in stabilizing the market by reducing the frequency and impact of mass liquidation events.

Stay informed, trade wisely, and remember that the use of leverage can be a double-edged sword.